Exactly how soon you might re-finance a home loan relies on the original financing words plus the version of refinancing you look for. Expect to wait no less than 6 months or over so you can two years.

In this post:

- Whenever Must i Re-finance The house?

- Whenever Could it be smart to Re-finance Rapidly?

- Is actually Refinancing Worthwhile?

- How Refinancing Impacts Your credit rating

When you’re mortgages will likely be refinanced immediately loans Northglenn CO in certain cases, your typically have to wait at least half a year before seeking a cash-aside refinance on your own home, and you may refinancing some mortgages requires wishing for as long as 2 years. Time limits confidence the sort of your completely new home loan and you will the sort of refinancing you find.

Past these types of day restrictions, there are other important concerns to consider before deciding when the refinancing-the whole process of taking out fully a special mortgage to exchange your current you to definitely-is practical for you.

When Ought i Refinance My house?

Certain old-fashioned mortgages enable it to be quick refinancing, but there are special instances one to impose delays before you can initiate the procedure:

Cash-away refinance

Enjoy about 6 months just after closure on your brand spanking new financial. A profit-out refinance integrates another type of mortgage having a loan supported by your household guarantee, that can be used to possess do-it-yourself tactics or any other goal you choose.

Changed loan

Allowed twelve in order to couple of years out-of closure. If for example the bank offered to a mortgage modification one paid off your own monthly payment count or longer your own payment term, the amendment arrangement typically requires one to wait several so you’re able to 24 months throughout the modification go out prior to trying refinance. You could look for home financing amendment in case there is financial difficulty, and several loan providers supplied them to individuals exactly who knowledgeable money decreases for the COVID-19 pandemic.

FHA Streamline Re-finance

Greeting no less than 210 days shortly after closing. When you have a mortgage backed by new Federal Casing Administration, commonly referred to as a keen FHA financing, that have at least six months’ property value on-time money, you range re-finance away from an enthusiastic FHA-acknowledged financial into the half dozen-few days anniversary of one’s earliest commission, or eight weeks (210 months) after closing for the new loan. FHA streamline re-finance money is at the mercy of charge and you will settlement costs similar to men and women charged toward FHA fund but have reduced stringent requirements when it comes to proof of income or any other monetary documentation.

Whenever Could it possibly be a good idea to Refinance Rapidly?

- To reduce their monthly premiums: Another loan with a longer fees title ount of monthly payment (a technique one to normally function enhancing the overall number you can spend over the life of the mortgage).

- To get rid of financial insurance: Traditional mortgage loans generally speaking wanted individual financial insurance coverage (PMI) for folks who set out less than 20% of one’s loan amount during the closure, and several regulators-supported financing need a month-to-month home loan advanced (MIP) if you do not make a deposit of at least 10%. If for example the residence’s market value has increased quickly, or if you obtain the new methods to set so much more down on an excellent the brand new financial, refinancing without having any weight from mortgage insurance rates could save you currency.

- To modify your interest: Substitution your mortgage with one that provides a lesser appeal speed decrease the total amount you can spend across the life of your own loan. Similarly, substitution an adjustable-rates loan, having repayments which can changes annually, to a very foreseeable repaired-rates financing could save you money and you will clear up cost management or other economic considered.

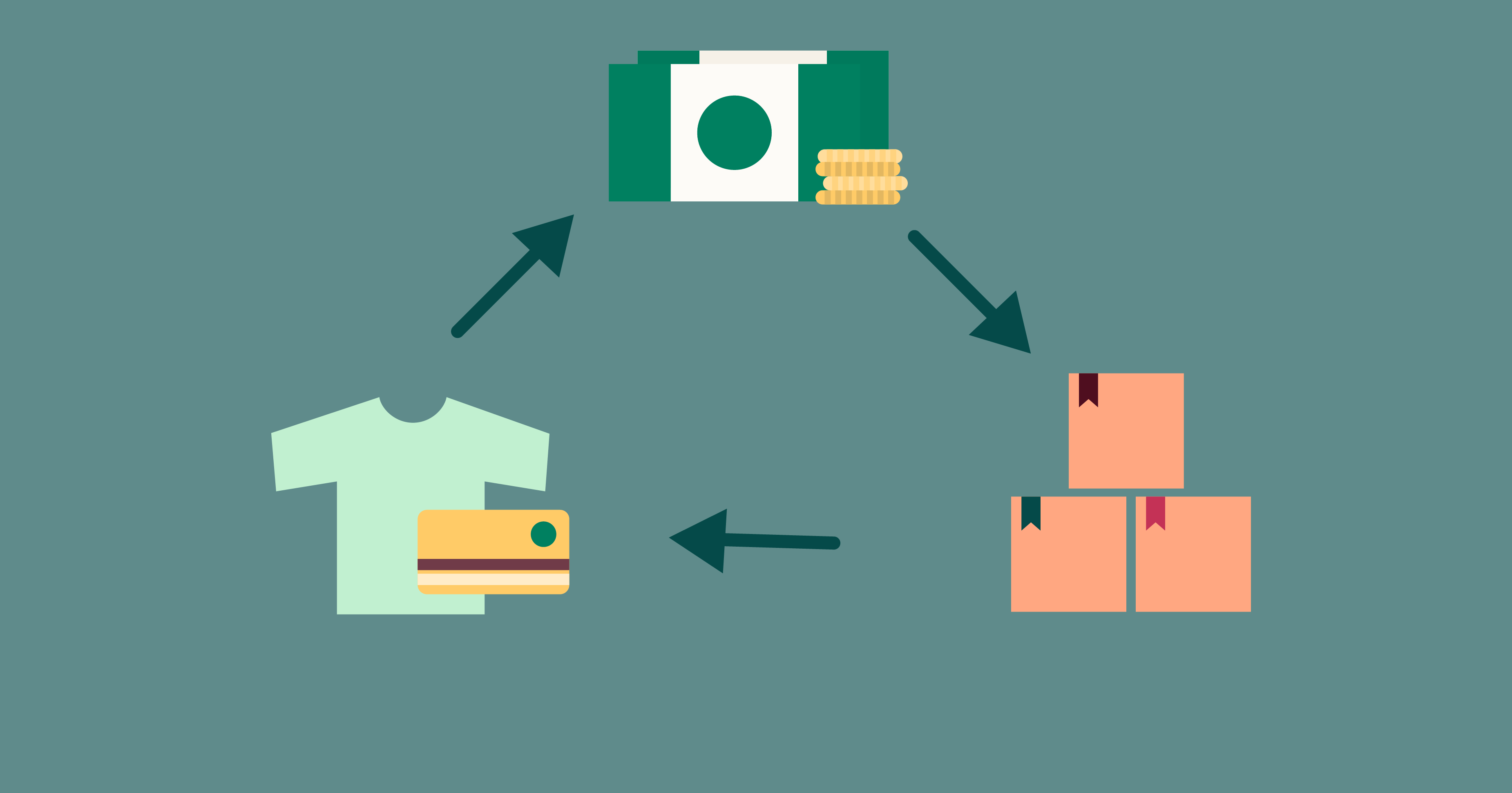

- To locate dollars: A profit-out mortgage that combines a special mortgage with financing supported by the household guarantee are used for do-it-yourself strategies and other mission you decide on. Note that your property security usually need to be greater than 20% on how to be eligible for a finances-out re-finance, therefore if you don’t produced a hefty advance payment in your original mortgage otherwise their home’s atically (and you will quickly), you might not have sufficient guarantee to have a funds-aside mortgage shortly after only half a year.