How to use it financial obligation calculator

Fool around with our very own calculator observe just how a debt settlement financing can make it easier to take control of your costs. Here’s how so you can modify it personal debt calculator:

- Loan balance: Go into the total matter you really need to use to cover their individuals debts. This can include unsecured loans, credit cards, cash advance, auto loans and you can figuratively speaking.

- Monthly payment: Sound right your latest monthly obligations towards certain expense you want to cover having an integration mortgage. Viewing exactly how much you pay a month between playing cards and you can money will help put your financial position to the direction.

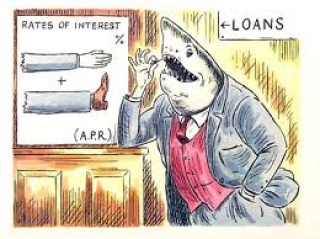

- Integration financing rates: Right here, possible connect on your own estimated annual percentage rate (APR). This may become notice costs and you will one charge you are able to shell out. You’ll find your own possible costs for those who prequalify for an effective loan . This enables you to see just what a loan provider can offer as opposed to one effect to the credit score. The costs could be dependent on individuals affairs including your credit rating, financing words and you may obligations-to-money ratio (DTI).

- Loan label: The loan label ’s the length of time you have got to repay your debt. That have a debt consolidation financing, you’ll generate equal monthly installments during your cost label. That have a lot of time words , you may have reduced monthly premiums however, highest rates. Having quick terms and conditions , simultaneously, you have higher monthly premiums but lower prices.

- Your results: After you plug regarding amounts, our very own online calculator can show your brand-new prospective monthly payment and you can the amount of money you could savepare your own savings with regards to the full notice you are able to shell out, new projected level of their monthly payment and just how long they takes to settle your debt entirely.

https://paydayloanalabama.com/vandiver/

Sign up for a consumer loan

These unsecured debt is not backed by any assets, which means you won’t are in danger off shedding your home, vehicle otherwise similar product for many who standard inside it. Right down to lenders taking up much more exposure, unsecured loans start from large rates of interest.

Think credit card debt relief

This kind of debt settlement gives you the ability to discuss your debt with your financial institutions possibly once the one otherwise due to a settlement company. The idea is to try to visited a binding agreement with your loan providers to repay having a smaller amount than what you owe. Regrettably, there is absolutely no make certain that creditors will invest in that it. Just remember that , credit card debt relief can show up on your credit history and might adversely perception your credit score.

Tap your house equity

A house equity mortgage allows you to acquire doing 85% of security in your home, and/or difference between the value of your property therefore the equilibrium of your home loan due inside. You could utilize the newest lump sum payment to pay off your own outstanding expense – but not, you could also cure your house if you default toward mortgage.

Use a balance import mastercard

When you you will spend virtually no notice during the advertising and marketing several months provided towards the a balance transfer card, you will likely still have to shell out an equilibrium import payment. Nevertheless, it could work with the favor whenever you shell out from the loan easily.

Use from your own old age

When you yourself have sufficient financing already secured on your own membership, you could potentially take-out a loan from the 401(k) to pay for your debts. Even though you would forfeit the interest who would was in fact paid in your account, you will get up to five years to invest back new fund instead of punishment. not, there are several tax effects with it. Plus typical taxation on the count you withdraw, you will also pay a taxation when you withdraw it once again when you look at the advancing years.

Nonprofit debt consolidation or obligations government bundle

Unlike taking right out financing to pay off your debts, you might run an effective nonprofit credit guidance service to discuss less rate of interest and you will monthly payment out of your bank card organization.