You can customize your COA so that the structure reflects the specific needs of your business. A COA typically includes a detailed list of accounts organized by categories like assets, liabilities, and expenses, each with a unique code. This structure aids in systematic transaction recording, financial tracking, and ensures consistent reporting across the business. A chart of accounts (COA) is grouped into main categories such as assets, liabilities, equity, revenue, and expenses for clear financial reporting. This categorization simplifies the preparation and analysis of financial statements, helping organizations track their financial health efficiently.

Best Free Accounting Software of 2024

Our team acts as your trusted advisor, ensuring your accounts are structured efficiently to capture every financial nuance of your business. Let’s begin with the basics of maintaining the chart of accounts in the SAP S/4HANA Cloud systems. In the following sections, we will explore the procedures for maintaining charts of accounts under different scenarios. It improves reporting standards by driving consistency across the entire company and different business units. This consistency then translates into comparability, which is essential when expanding with new product lines or growing into new verticals. By adhering to these best practices, you can maximize the utility of your chart of accounts, enhancing both financial transparency and decision-making capabilities within your organization.

Master Your Financial Foundation: How doola Bookkeeping Can Optimize Your Chart of Accounts

Your chart of accounts is a living document for your business, meaning, over time, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts. A chart of accounts is a critical tool for tracking your business’s funds, especially as your company grows. Without a chart of accounts, it’s impossible to know where your business’s money is.

Income Statement Analysis

The first three are assets, liabilities, and equity, which flow into the balance sheet. The remaining two are income or revenue and expenses, which flow into the income statement. Some businesses also include capital and financial statement categories. To create a COA for your own business, you will want to begin with the assets, labeling them with their own unique number, starting with a 1 and putting all entries in list form.

An added bonus of having a properly organized chart of accounts is that it simplifies tax season. The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year. A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in xero expenses on the app store your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses. Doola’s bookkeeping services provide expertise in setting up and customizing a chart of accounts based on your business’s specific needs. For example, within assets, you might have cash, accounts receivable, and inventory accounts.

- These earnings are retained within the company to be reinvested in the business, finance expansions, or repay debt.

- When setting up a chart of accounts, it’s important to establish a consistent and logical account numbering system.

- Members of the accounting team can view existing G/L accounts and FSVs in the production system.

- When you log into your bank, typically you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each.

- Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging.

- Income statement accounts are used to create another important financial statement.

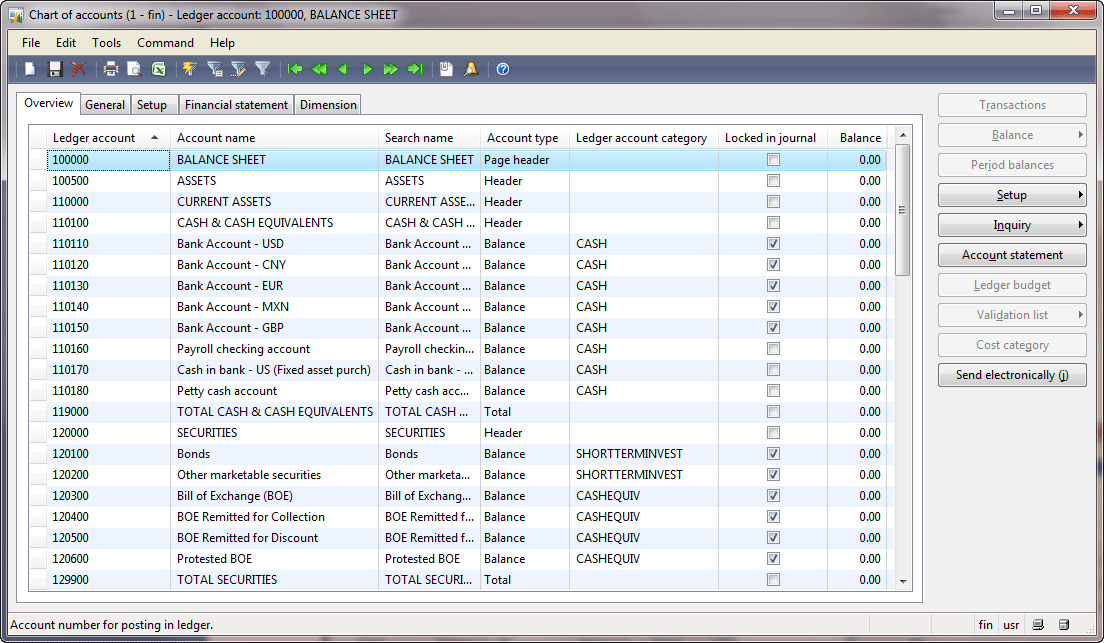

Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them. There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key. The more accounts are added to the chart and the more complex the numbering system is, the more difficult it will be to keep track of them and actually use the accounting system. The chart of accounts is a list of every account in the general ledger of an accounting system. Unlike a trial balance that only lists accounts that are active or have balances at the end of the period, the chart lists all of the accounts in the system.

The main account types include Revenue, Expenses, Assets, Liabilities, and Equity. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards.

If used by a consolidated or combined entity, it also includes separate classifications for intercompany transactions and balances. A chart of accounts is a document that numbers and lists all the financial transactions that a company conducts in an accounting period. The information is usually arranged in categories that match those on the balance sheet and income statement. For entrepreneurs, a well-organized chart of accounts is essential as it provides clarity in tracking income, expenses, and cash flow. This structure helps with accurate financial reporting, budgeting, and strategic planning. Transaction Matching automates the matching of transactions across various data sources, aligning line-level transactions efficiently.