As opposed to providing evidence of earnings that have taxation statements, traders give factual statements about the home to help lenders assess the DSCR – new property’s leasing earnings split from the mortgage loans. A beneficial DSCR of 1 or higher ensures that the new borrower’s property earns adequate currency to purchase debt. Still, loan providers normally want to see an effective DSCR of just one.twenty-five or maybe more because it function the new borrower have currency leftover over to work at the company and you may pay for additional expenditures you to could affect their capability to spend its financial.

Get a low-QM Loan Now

To purchase a home without a job is possible, it are more complicated so you’re able to be eligible for. The main thing to consider will be your capability to pay back the loan. Without having employment does not mean you don’t need to earnings. Although not, you should be sure to have sufficient earnings compared to your debts to cover the the month-to-month mortgage repayments.

Is it possible you get home financing without a job? Seriously, but you’ll have to satisfy your lender’s requirements. Keep in touch with a great Griffin Investment financial pro today to know about financial choices for people with choice resources of money, or apply on the web now. You can expect various Low-QM mortgage loans to any or all brand of consumers and can help you can see the proper alternative according to your unique activities.

Do i need to score a home loan easily gotten a job render however, haven’t come but really?

Yes, you can aquire a mortgage for folks who receive employment bring and you can haven’t started yet. Like, the majority of people buy residential property in other says no wait cash advance Geraldine AL whenever transferring to own works. In these instances, you could potentially ask your manager having a non-revocable a position contract giving the lender to show which you can found a-flat earnings and become employed for a designated amount of your energy.

You may also express your offer page on home loan company to prove you will be able to repay the loan just after you begin the new work. But not, its beneficial to illustrate that you keeps high cash supplies so you’re able to build your application more desirable.

May i get home financing with no occupations but a huge put?

Expenses Lyons is the Maker, President & Chairman away from Griffin Funding. Established during the 2013, Griffin Investment are a nationwide boutique lending company targeting getting 5-superstar solution in order to the subscribers. Mr. Lyons possess twenty-two years of experience with the loan company. Lyons is seen as a market chief and you will expert in the real home fund. Lyons has been checked inside the Forbes, Inc., Wall structure Road Diary, HousingWire, and more. Since a person in the borrowed funds Bankers Association, Lyons could possibly maintain essential alterations in the brand new world to transmit the essential value so you can Griffin’s clients. Below Lyons’ leaders, Griffin Financial support has made the new Inc. 5000 quickest-expanding people list five times in its 10 years in operation.

Most of the borrower is different, very whilst getting home financing without a job is achievable, you must know your unique finances to search for the proper day. If you opt to continue the borrowed funds process, the way to alter your probability of taking recognized to have a mortgage would be to increase your downpayment to cease a few of the it is possible to demands.

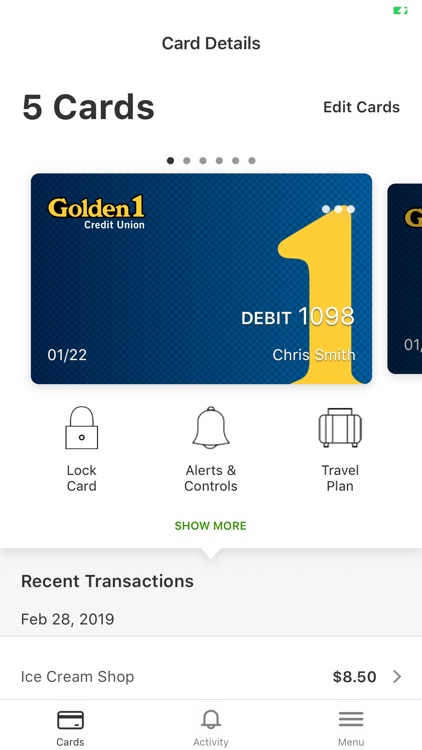

Download the newest Griffin Gold software now!

This type of finance are typically good for people taking high deductions on the taxation statements and reduce the nonexempt money. In this instance, it is far from that they cannot pay off the mortgage; it is simply one to their taxation statements county a lower money than simply whatever they its make, that can affect their capability to help you safe home financing founded towards strict lending standards.